Making tax digital for VAT: what you need to know

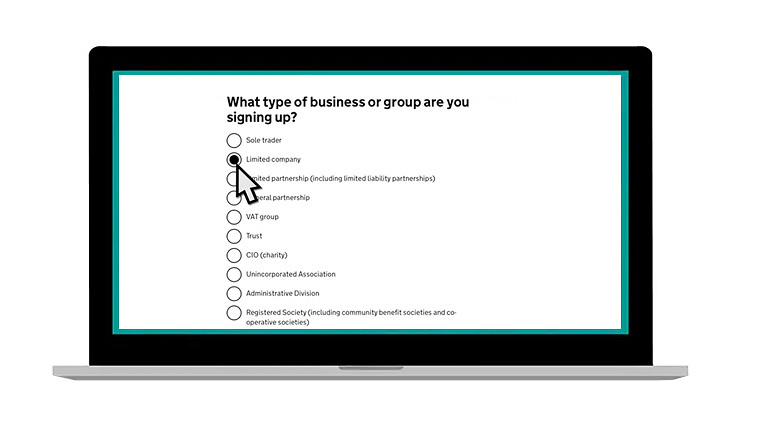

This year, VAT has changed. Up until now many VAT-registered tradespeople have kept paper records (including receipts and invoices) and submitted paper returns. However, as of April 2021, the Making Tax Digital for VAT service will come into place.

Tradespeople with a turnover exceeding £85,000* are required to keep digital records and use digital software (compatible with the government’s online system) to submit VAT returns. Tradespeople with a turnover below £85,000 will need to follow the Making Tax Digital rules for their first return starting on or after April 2022.

Why is HMRC doing this?

HMRC say it’s a way to make things easier for individuals and businesses. HMRC also want to modernise and follow the global trend for digitising business, moving away from paper records to a more accurate and advanced digital tax system.

HMRC plan to make all tax digital, but they’re helping businesses and self-employed people transition slowly – starting with VAT and income tax.

How will it affect you?

Tradespeople with a turnover exceeding £85,000* are required to follow the Making Tax Digital rules from April 2021. Tradespeople with a turnover of less than £85,000 (even if you’re VAT registered) will need to follow the Making Tax Digital rules for their first return starting on or after April 2022.

- If you’re already using compatible online accounting software, or software that can connect your spreadsheets to HMRC, you don’t need to do anything.

- If you’re not using software yet, you’ll need to find a compatible software package and start to keep accurate records (expenditure, income etc) digitally.

HMRC have made a list of compatible software. Find one to use on Gov.uk.

What else do you need to know?

It may be tempting to put this change off, especially if admin or using new software are the last things you want to think about. But, the sooner you start the easier it will be. Leaving it to the last minute will almost certainly make the whole process more stressful. If you are below the VAT threshold, you’re able to voluntarily join the Making Tax Digital service now.

To make things simpler, test out digital software and choose one you find easy to use. Keep your records updated on a monthly basis and make sure to keep track of earnings, receipts and expenses.

If you’re looking for more help and advice, head to Gov.uk.

*If your turnover is soon to exceed £85,000 you need to register for VAT.

One Comment